Oliver Wight

Oliver Wight are leading business improvement specialists who educate, coach and mentor people to lead and sustain change on the journey to business excellence and outstanding business performance. The largest worldwide consultancy of our type, we have offices throughout Europe, North and South America and the Asia Pacific region.

Sustainable Business Improvement through Knowledge Transfer

Sustainable business improvement can only be delivered by your own people. And we can help – by transferring our knowledge to your organisation; knowledge that comes from many years of working with some of the world’s best-known companies.

Successful S&OP through Integrated Business Planning

Sales and operations planning can enable any organisation to streamline its activities and boost profitability – but only if it is properly understood and implemented. This series of articles from experts at Oliver Wight reveal the secrets of successful S&OP implementation through Integrated Business Planning.

Always Read the Label

When it comes to best practice in operations management, few would dispute the value and credibility of sales and operations planning (S&OP). The problem, however, is that while many believe they understand S&OP, they don’t always realise its full potential because they fail to grasp the true fundamentals of the process. That isn’t necessarily their fault; to some extent, S&OP has lost its way in recent years. Changes in the economy and the dynamics of the manufacturing supply chain, plus the actions and attitudes of manufacturers to those changes, have all had their part to play. And it is also true to say that some S&OP practitioners themselves, have contributed to the devaluation of S&OP as a management process.

Put simply, S&OP ensures the business is working to one agenda: it has one set of priorities, which are then managed through one set of numbers, whilst driving the entire business towards its aspirations and strategic goals. It should a ‘total business management’ process, which integrates the core processes of that business – demand, supply, product management, sales and marketing, and finance – so a picture can be developed over a rolling two-year horizon. No short-termism; no fire-fighting.

Properly implemented S&OP should and, in many cases does, become the heartbeat of a company. Not only do the monthly S&OP meetings take the highest priority but the actions and analysis they trigger govern the whole company’s programme for the months ahead.

It is often the case that the biggest fans of the process are sales and marketing because they see it driving the business to their agenda of value growth through product and service innovation and sales excellence. In a typical monthly S&OP exercise, sales and marketing uses a variety of techniques and rigorous process to establish projections of future demand, to create an updated rolling demand plan. Operations management then develops a realistic supply plan to meet that demand over the next 24 months.

“Integrated Business Planning must run the entire organisation, linking back to the business and financial plans of the company.”

In recent years, organisations of varying credibility have claimed to offer S&OP solutions but which fall well short of delivering on these principles. This has served to undermine the original total business management message and has led to the situation where many believe S&OP to simply be a demand-supply balancing process – even pigeon-holing it as a logistics or supply chain solution. This isn’t the right focus: it will not reap the required benefits and it’s why the view has formed in some quarters that S&OP has not lived up to expectations.

There are many thousands of companies who today, operate some sort of S&OP but it varies greatly from one organisation to another. It is described by some consulting firms as ‘aggregate/volume planning for the supply chain.’ However, that totally misses the power of this process to provide the link back to the business plan and strategy and hence provide a fundamental management process.

Nonetheless, true S&OP is still bringing dramatic benefits to major organisations around the world. Indeed, independent findings by leading research and analyst firm Aberdeen Group shows that those companies that successfully implement S&OP – regardless of size or sector – will routinely outperform their competitors by a factor of 20% or more*. Meanwhile Gartner says S&OP is a corporate imperative and that 70 percent of companies will be forced to upgrade their S&OP processes by the end of the decade**.

Oliver Wight were the originators of S&OP more than two decades ago and the power of S&OP in its own right has been well established over that time – as a board level process which interprets the business plan in a way which enables a review of demand and supply plans at an appropriate level of detail every month; to understand change and revise plans accordingly.

“Put simply, S&OP ensures the business is working to one agenda: it has one set of priorities, which are then managed through one set of numbers.”

But things have changed. Nowadays, organisations increasingly refer to their S&OP process as Integrated Business Planning (IBP), a term first coined by Oliver Wight back in 2005. Although the degradation of the term ‘S&OP’ means even a straightforward rebranding would have done no harm, this is not simply a name change but an evolution of the process itself. There are a number of reasons for this evolution. Firstly, the appeal of the S&OP process has broadened significantly beyond its original ‘manufacturing only’ audience – these days S&OP principles have also been adopted by retail and service organisations. Equally, manufacturers themselves have changed enormously, many offering services far beyond traditional production. And while the underlying message remains the same, the terminology itself also has to appeal to different types, scope and maturity of organisation. Now, the focus is to embrace and deploy strategic planning; it has to extend beyond operations to encompass product development, finance and strategic alignment.

IBP adds a strategic perspective to S&OP. S&OP as still practised by many, is a short-to-medium term demand-supply planning process based on volumes. It asks what volumes the company expects to sell; it tries to bring supply into balance with that demand, and to examine and fill gaps between the two.

That’s quite different from IBP. IBP must be positioned as the business management process; it must run the entire organisation, linking back to the business and financial plans of the company. Those plans must be integrated and set over a rolling horizon, appropriate for the business – 24 months is typical – and the financial consequences have to be reviewed alongside operational plans via the monthly review cycle. The entire planning process is driven by strategic objectives and business commitments, underpinned by clear facts and assumptions. The focus is on understanding and responding to change and thereby recognising, managing and closing performance gaps.

With this level of visibility, performance gaps in the organisation can be detected and closed well in advance – by people at the appropriate level in the business. Indeed, one of the key fundamentals of IBP is to enable more and more people within the business to become involved in making day-to-day decisions. It’s a truly exciting process: it engages everyone with solid, accurate data that they trust, so the business can move forward, confident in the decision-making capability of its people.

S&OP may appear straightforward, but it requires a structured approach to realise its full potential. Lloyd Snowden says it’s important to play your cards in the right order.

All in Good Time

Let’s look at the symptoms a company may be exhibiting when sales and operations activities are not aligned and integrated – fire-fighting, blame, recrimination, and poor performance levels throughout the organisation. There will be few (if any) performance measures in place and no means of improving the accuracy of data to measure performance. The symptoms can apply irrespective of company type.

So little or no process exists to improve overall performance of the organisation. Small problems can quickly escalate into large issues, which can adversely impact the company’s performance. As each function or department within the organisation jostles for position to satisfy its own priorities, valuable time and resources are wasted, ultimately leading to poor business performance. The senior management team or board may continually be presented with surprises – results they were not expecting. The reasons can be numerous, but note, they can also be very simple. Consider this example, which will ring true for many. A firm has a sales team which consistently understates its forecast – because the organisation operates a system which rewards individuals who beat their forecast. In contrast, production is repeatedly overstating its ability to meet demand. The result? The perfect storm.

Clearly, not all organisations recognise they have a problem with S&OP. Sometimes, the problem is less well defined. Senior managers may simply be frustrated with the fact they’ve tried to implement all manner of initiatives, some of which are known to deliver percentile improvements, but improvements in their own company have been short-term and/or seem small in comparison with those achieved by other organisations.

The reason is timing: Oliver Wight’s maturity map explains this – it positions an organisation in terms of its readiness and capability for performance improvement in ‘the journey to excellence’. There is a ‘right time’ for improvement initiatives to be applied. For example, ‘continuous improvement’ is the technique most suited to those organisations situated in ‘Phase 1’; only when they are pushing ‘Phase 2’, should organisations really seek to achieve the benefits from Lean methodologies. Once the performance level is approaching 99.5% (at the top of ‘Phase 2’), that’s the time to focus on remaining the 0.5% error, using parts per million or Six Sigma. And so on.

“There is a logical sequence to the application of improvement initiatives. These should be managed with a structured programme based on the maturity of the specific business.”

— Lloyd Snowden Senior Consultant Oliver Wight EAME

So, there is a logical sequence to the application of improvement initiatives. These should be managed with a structured programme based on the maturity of the specific business. Whether continuous improvement, Lean, Six Sigma or any other technique, all improvement initiatives have their place, but the order of their application will govern the long-term success. The tools are all valuable in their own right, but without the necessary foundation, they are more difficult to sustain. Of course organisations do apply these techniques at varying levels of maturity but the most successful do it when they are ready for the next sustainable improvement.

Success is very much dependent on people and their behaviour. Part of the education process for S&OP and Integrated Business Planning (IBP) is first to teach people about best practice and then for them to apply that best practice to the company’s particular requirements. This is partly achieved through workshops, which deliver further detail, and which also allow participants to stand back and work out for themselves how the techniques might apply in their own operation.

While it is vital to understand the organisation’s present capability because this dictates the likely span of improvement for the future, the IBP process changes the focus from the next month or quarter, to month 24. But this change in focus will not materialise overnight: people cannot be expected to switch immediately from the old way of working. It may well require a gradual shift – for example from months two to four, to two to six, followed by four to nine, and so on. Once the focus begins to change, however, the business can be confident that people left to run the short term, are able and capable and feel supported because they are given accurate data they can have confidence in. Think of it as decompressing the organisation to give it space to plan ahead.

Sustainability is very much dependent on the client organisation. Education on change takes place at the top and ‘change agents’ are the focus of this transfer of knowledge – they are shown the methods to apply best practice knowledge to their own organisation and they are urged to design education material to cascade this information to their people. This is a crucial factor in the success of IBP programmes: those organisations which use the internal cascade process achieve significantly greater benefits than those that don’t. The people are engaged in the process, which in turn results in a faster turnaround for the business.

Some of these turnarounds are rapid; others can take a couple of years. But for the organisation with determined people to drive the programme forward, the benefits can be staggering. Increased profitability is high on the results agenda – again, the starting point for each organisation clearly plays a significant role here. Most companies tend to aim for 10-15 percent profitability. When they begin the programme, this figure could be as low as 2-3 percent or, worse still, in the negative. It is not unusual, therefore, to see a swing in profitability of as much as 20 percent. Also significant in terms of percentages are reductions in inventory: some companies have been able to cut this by as much as 60 percent.

Failures for Oliver Wight are rare because companies which don’t display the required level of commitment can easily be identified at the outset. There is little point engaging with an organisation if the senior management is unconvinced of the need for change. All-round commitment removes the risk of failure.

IBP will enhance sales and operations planning. It will enable the organisation to make the fundamental shift from finances being the driving force for all management activity, to the point where the finances are the consequence of slick processes that perform consistently well, time and time again.

Andrew Purton says Integrated Business Planning has superseded S&OP as the process which ensures operational plans are managed from an integrated business perspective.

Constantly Under Review

The common dilemma for companies which have invested significant time in developing a meaningful strategic plan is how to ensure it truly guides the business to a new future rather than just being a onceper-year corporate exercise. To make strategy real, the business objectives, focused programmes and short-tomedium term milestones, must all be integrated within a monthly business review cycle.

Equally, any S&OP process has to be consistent with the strategic direction of the business and monitored against it; and the resulting plans have to be optimised in response to change and the latest business projections. Regular business reviews are essential to manage change in the business, whether that change comes from external or internal sources. And these days of course, change is occurring at an ever-increasing rate – fuelled by marketplace dynamics and new technology. Whilst businesses will still be held accountable by their investors for delivering commitments on profitability and shareholder value, it is fundamental that the business is managed based on prevailing conditions and latest assumptions. Hence the need for an Integrated Business Planning (IBP) process.

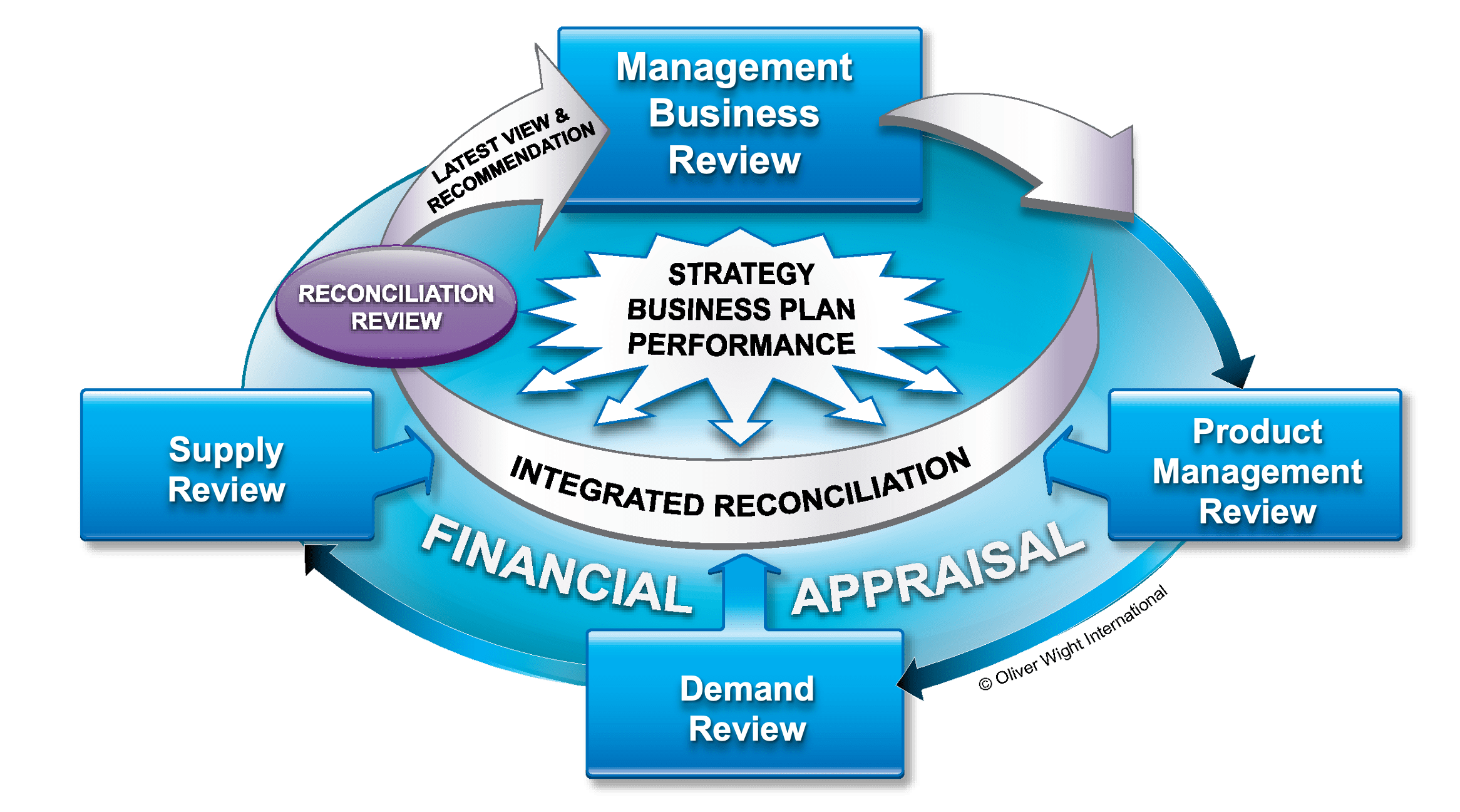

Although IBP has to be implemented to suit the specific nature, accountabilities and structure of the organisation, it is always founded on a monthly cycle of business reviews: product management, demand, supply, integrated reconciliation and finally, the management business review. Each review is chaired by the executive accountable for that area of the business and facilitated by a ‘process co-ordinator’. And it is attended by a cross-functional team, responsible for executing the commitments and plans coming out of each review. So what’s involved?

1. Product Management Review: A crucial difference between IBP and a typical S&OP process is the inclusion of product management. This can be a dynamic environment where uncertainty exists, change is rife, demonstrable performance may be difficult to determine, and resource is not well balanced. What changes are taking place (and when) over the horizon to ensure an attractive product portfolio that will deliver market share and product profitability objectives? What new products will be introduced, existing products discontinued or changed, and what will be the effect of marketing-led promotional activity? What is the time-phased plan? This review is fundamental to understanding what is happening to the business and the resulting impact on demand, supply and financial planning, and to make decisions to recover, rebalance or reprioritise.

2. Demand Review: Demand will change in response to economic, industry and market forces – growth, inflation, exchange rates, consumer confidence, competitive pressures, changing promotional activity, market size, the availability of new products and so on. We need a process to assess our forecasting capability and sales planning performance; to use this information to generate the latest view from the marketing and sales teams; and to underpin it with volume and revenue statistical projections. Assumptions must be explicitly documented to provide visibility and understanding, and the sales and marketing views reconciled to gain consensus on a ‘most likely’ demand plan.

3. Supply Review: Is the supply chain performing – supplier delivery, through conversion and master supply plan performance? What is the demonstrated performance of operations and what is the timing of improvement programmes, so there is clear understanding of supply capability and flexibility? What is the impact on the supply chain of changes in demand and the timing of product development? Are there material constraints in supporting the new demand plan and is there sufficient resource? What are the options and opportunities?

4. Reconciliation: Change would typically have been identified in all of the above reviews and a continuous reconciliation process is required to address and resolve the issues arising, to re-optimise the business, and manage any gap between the business strategy and the expected forward business performance. Reconciliation needs to get beyond the numbers to a real understanding of the key business levers and forces at work, and to model scenarios. The integrated picture and real management issues can then be presented to the senior team succinctly, with options and recommendations.

5. Management Business Review: Unlike many socalled S&OP meetings where a pack of spreadsheets are laid before the management team who are then asked to play “hunt the numbers”, this final step must be based on real management information – a review of key performance indicators and analysis of trends in operational and financial performance, highlighting gaps versus business and strategic plans. It will present issues arising, together with the underpinning understanding of assumptions, vulnerabilities and opportunities, which have either been resolved at prior steps or require a decision based on the recommendations from the reconciliation review. This review will approve the forward plan that will provide clear visibility for the single set of numbers driving the integrated business.

“Integrated Business Planning is not a series of discovery meetings but a continuous process; it orchestrates those who are business-accountable to review, present and communicate progress and change.”

So, IBP is not a series of discovery meetings but a continuous process; it orchestrates those who are business-accountable to review, present and communicate progress and change. The reviews must be action-oriented and they demand rigorous preparation to identify issues and scenarios for consideration in advance of the meeting, so decisions can be made and revised plans agreed before they are made visible across the entire integrated process. The review meetings are diarised from the outset and those involved have to prioritise those dates – nothing should be more important; after all, this is the management process running the entire business.

As we established earlier in this publication, the majority of businesses are not managed in such an integrated way: ‘Supply chain’ are working from a volumebased plan they generated themselves and complain about lack of commitment to it by ‘sales’, while ‘sales and marketing’ each generate a different view of demand to fuel their own functional needs. Finance receives a valuebased projection from ‘sales’ with no means of reconciling with the volume-based plan used to drive supply. Then throw into the mix the marketing stretch goals and how to support the upside with product if the upside happens, versus the pressure for reduced inventories and improved OEE, yet a tendency for conservative external reporting, and you have a recipe for not just two but multiple sets of numbers.

Most companies’ planning falls at the data collection hurdle. The data may not be accurate, so due process and focus must be applied. Even where it is accurate, there may be insufficient integrity in the data as it flows through the planning process. For integrated planning based on oneset of integrated numbers, the data requirements have to be established at the outset, along with the mechanism to convert data into usable formats and to flag the exceptions whenever and wherever data cannot flow.

Even for those companies that succeed with common plans and effective data, integrated planning is usually limited to the tactical and operational level. However, integration with the business strategic plans can dramatically transform this process. It brings the strategy to life if each month the latest operational plans and projections are challenged for fit with the strategic direction. This is in stark contrast with the fate of many well developed strategic plans – confined to the filing cabinet because of the lack of a forum for effective review.

IBP is also a crucial step to improving the supply chain. Putting your own house in order is all about driving internal collaboration and the links with your immediate customers and suppliers. Once that internal collaboration is strong enough to deliver effective plans (which you can execute with 95 per cent, plus, levels of operational performance to plan), you can begin to influence and manage external collaboration over the extended supply chain. This then defines the next level of maturity to an increasingly capable integrated supply chain model and the IBP process on a perpetual journey to Class A performance.

So, unlike traditional S&OP, IBP is a monthly rolling management process that seeks to optimise the business whilst monitoring deployment of the strategy. It provides a fully effective means of managing and growing the business. Get it right and it will deliver substantial benefits straight to the bottom-line.

There are many Oliver Wight clients who have successfully implemented Integrated Business Planning (S&OP). Here, five of them tell their own story.

A Case in Point

Heinz

At food giant Heinz, Integrated Business Planning (IBP) began as a localised programme to support continuous improvement of European operations. Within three months the project had become the company’s global strategy, extending beyond planning and forecasting into finance, customer service and new product development (NPD). The benefits have been farreaching, delivering performance metrics of up to 99 percent. For an organisation the size of Heinz, eliminating volatility in these key business areas presents enormous challenges – retailers are demanding ever greater levels of customer service, with daily deliveries and zero inventory, whilst the massive demand for its products (like the company’s iconic tomato ketchup) necessitates meticulous control of supply, right down to SKU level.

What became known as the ‘Heinz Business Management’ (HBM) programme was established across all four continents – a team of 12 ‘regional implementation managers’ supported by Oliver Wight, was appointed to manage the programme and the team set itself the challenging target of reaching world class performance inside 15 months.

It achieved that objective, receiving its first Class A Milestone award from Oliver Wight in June 2006, but the benefits started to come well before then – establishing ‘one set of numbers’ at the outset, allowed Heinz to identify a gap in its forecast revenues immediately, and the resultant sales and marketing campaign delivered a return of five percent direct to the bottom line. Before HBM, if there was a forecast shortfall in revenues at the end of the quarter, there may have been a temptation to rush through the introduction of a new product to try and fill the gap – risky if this meant compromising retailer and consumer testing. HBM business leader Gerard de Bruijn: “NPDs can be problematic because of great variation in the duration of projects and availability of personnel; resources have to be carefully balanced between local and international, permanent and temporary staff. Getting it wrong can be very costly,”

Now, with its supply and demand volatility minimised, Heinz has a 24-month horizon for its NPD strategy with between 20 and 30 high-end NPDS in progress every year – via the product management review process, products are introduced according to a structured launch programme with robust financial projections, and rigorous consumer and retailer testing. Meanwhile, its business review process ensures that individual objectives and activities are linked right through to the corporate strategic plan, with slick monthly reviews carried out at all levels of the organisation, allowing the company to respond quickly and effectively to change.

The original objective of establishing predictability in the European business has also been achieved, with improved customer service, and enhanced consumer and business relations, all following as a result. De Bruijn says: “Customer service performance now averages 99%, while demand and supply accuracy have just 5% and 2% volatility respectively; safety stocks of key products have been reduced and financial accuracy has a volatility of just 2%.”

“Our dual strategy was to introduce operational excellence at the same time as delivering a valueadded proposition around improved customer service.”

— Pieter Kruithof Supply Chain Director Farm Frites

Smith and Nephew

Smith and Nephew was recognised for the success of its Integrated Business Planning (IBP) programme, when it received the Manufacturer magazine’s ‘Logistics and Supply Chain Award’.

Smith & Nephew employs over 8,500 people worldwide and generates annual revenues of $2.6 billion. The company’s Wound Management division embarked on an IBP programme to align its sales strategy with its operational capability and supply chain design.

Paul Adams, Smith and Nephew’s supply chain director: “It’s a classic problem in many big organisations that if the supply chain is poorly designed, there will be a negative impact on profit. If your business objective is to push top line revenue growth, you risk high costs and poor service – you release sales people into the market and you will probably get a whole set of new accounts all generating small orders, which cost you more to fulfil than the revenue they generate, so the more you sell, the more you lose.”

Headquartered in Hull in the UK, Smith and Nephew Wound Management supplies dressings, pharmaceutical products and electronic devices to 38,000 customers in 124 markets around the world. The company’s mission statement is ‘to help people regain their lives’ and the effective supply of product is critical. In October 2002, 180 people were killed and many others injured in the Bali Bombings; the day after, Smith & Nephew’s burns products were already delivered and helping patients. Nearly one quarter of all advanced wound products were donated by Smith & Nephew.

IBP has helped Smith and Nephew change its business model completely, introducing channel intermediaries to service small orders. It has seen a 20% increase in manufacturing capacity and added 3 margin points in net profit in one European market alone, whilst maintaining sales growth. Inventory has dropped and Smith & Nephew offices now supply fewer delivery locations with larger orders – in fact average order size in some Smith & Nephew’s markets has increased by up to 60%, whilst, following consolidation, SKUs have been reduced by 50%. Customer delivery time is also faster, with pan-European warehousing delivering to customers within 24 hours. “Forecast accuracy has risen from 60 percent to 80 percent for 70 percent of products and every day people look at better ways to serve our customers,” says Adams.

“Forecast accuracy has risen from 60 percent to 80 percent for 70 percent of products and every day people look at better ways to serve our customers.”

— Paul Adams Supply Chain Director Smith and Nephew

Farm Frites

Farm Frites has been a family-owned business since it was established in 1971. Headquartered in Oudenhoorn in The Netherlands, it is the world’s third largest potato processing company, with offices in 13 European countries. It has 1,700 employees across eight manufacturing facilities. With the objective of increasing the scale of its business, while reducing the cost of production, Farm Frites began an Integrated Business Planning (IBP) programme with Oliver Wight.

The company made rapid progress through the establishment of integrated supply, demand and product management reviews and is now heading for Class A status. Pieter Kruithof, supply chain director, says “Our dual strategy was to introduce operational excellence at the same time as delivering a value-added proposition around improved customer service. Ours is a commodity product in a complex industry with a volatile supply chain – our raw materials come from the land and are subject to the vagaries of the weather.” Nonetheless the company identified the potential for €1.5 million of savings and is already half way towards achieving them. Geert Jackers, integrated reconciliation manager, with overall responsibility for running the programme, says the transparency delivered by IBP has ‘pulled the walls down’ between departments and dramatically improved forecasting accuracy: “In two years there has been a 33 percent uplift in forecast accuracy.”

And when a bad potato crop in 2006 put pressure on short-term profits, the company didn’t abandon its Class A principles; focusing on innovation rather than cost cutting, it devised a brand new pricing structure which is now being imitated by competitors.

DSM NeoResins

At DSM NeoResins, being ‘best in class’ is not a matter choice but of survival. Headquartered in Waalwijk in the Netherlands, DSM NeoResins operates across five sites, including the USA, China and Spain. The €multi-million turnover company employs nearly 650 people, producing waterborne technologies, such as acrylic emulsions and polyurethane dispersions, for application in paints and coatings, printing inks, varnishes and adhesives. It depends heavily on new product introduction for its market-leading position and achieved Class A status in 2006.

With origins in the US going back to the 1950s, the company first started work with Oliver Wight 14 years ago, when it was part of the ICI Group. Regular corporate changes over the years had played havoc with the long-term vision of the business and this had previously hampered the programme; two troublesome SAP implementations added further complication, but In 2005 NeoResins was acquired by Dutch chemicals giant DSM and with the new owner came a cultural and business synergy that provided a fresh impetus.

Caroline Moon, finance and supply chain director, says the benefits of the programme have been far-reaching: “We work to one set of numbers right across the globe with a 24-month rolling forecast by customer, product, segment and plant. We’ve eliminated three layers of process and saved five man-days a month on the paperwork for S&OP, and there are no more endless debates on the accuracy of the figures. The working-capital-to-sales ratio has reduced from more than 18% to less than 11% and we’ve seen a substantial increase in stock turns, whilst increasing OTIF out to the customer. That confirms the optimal alignment of our processes”

However, even as it was integrating with its new owners, NeoResins faced a surge in demand, matched by an equally sudden shortfall in the availability of raw materials. Its usual 95%-plus on-time-in-full (OTIF) performance dropped significantly in a matter of months and the company’s proud reputation for delivering orders onrequest was under threat. The experience turned out to be a clear demonstration of the importance of effective S&OP and incontrovertible evidence that it was truly embedded into the culture of the company: Senior business director, Sjaak Griffioen, says, “It was a difficult time; our customers helped us but Class A saved us because the willingness to put things right was already in place.” OTIF was restored to a sustainable 95%-plus inside a few months.

“We’ve eliminated three layers of process and saved five man-days a month on the paperwork for S&OP, and there are no more endless debates on the accuracy of the figures.”

— Caroline Moon Finance and Supply Chain Director DSM NeoResins

npower

It isn’t just manufacturing organisations which can benefit from Integrated Business Planning (IBP). The retail division of energy supplier, npower, was recognised for the success of its Oliver Wight programme at the CIMA Financial Management Awards.

Faced with dramatic changes in market dynamics and a new CEO, plus major company restructure and increasing shareholder demands, npower implemented IBP to align its business and raise the bar on performance. Just six months into the programme, the company’s CEO, David Threlfall was describing IBP as “the way we run our business.”

IBP has been rolled out across the whole of npower Retail and Trevor Yeoman, business excellence programme leader, says it has turned the 8,500-employee company into ‘a retail business with a single agenda’

It has broken down a silo mentality within the organisation and encouraged interaction, communication and co-operation between departments,” he says. This ensures end-to-end decision-making, which allows the business to be more proactive in its forward-planning and scenario-planning, and to move quickly in the dynamic utilities sector.

Decisions are now being made at the appropriate levels, with team managers dealing with the day-to-day running of the business, leaving the senior management team to deal with the longer-term, strategic focus of the business. Meanwhile, the finance team has evolved from ‘just keeping score’ to being key to business activities and decisions.

Programme manager for npower, Massimo Stanghellini, says success has come from deep within the organisation “Individuals and teams have become re-energised by IBP; they take ownership and their activities are now fully aligned to the company’s KPIs.”

“Integrated Business Planning is the way we run our business.”

— David Threlfall CEO npower

Whatever lies ahead we can help you plan for it.

The difference between successful organisations and the rest, is their ability to anticipate and respond positively to changing conditions. Oliver Wight's Integrated Business Planning will make sure you're prepared for the future, whatever it holds.

To find out what lies ahead, contact us.